ELM TREE PARTNERS

MARKET NOTE • FEBRUARY 2, 2026

The Real AI Trade on February 2

Wasn’t Palantir at $156.

Natural Gas Crashed 25.7%. That’s the AI Fuel Cost Reset Nobody Is Talking About.

I. The Numbers

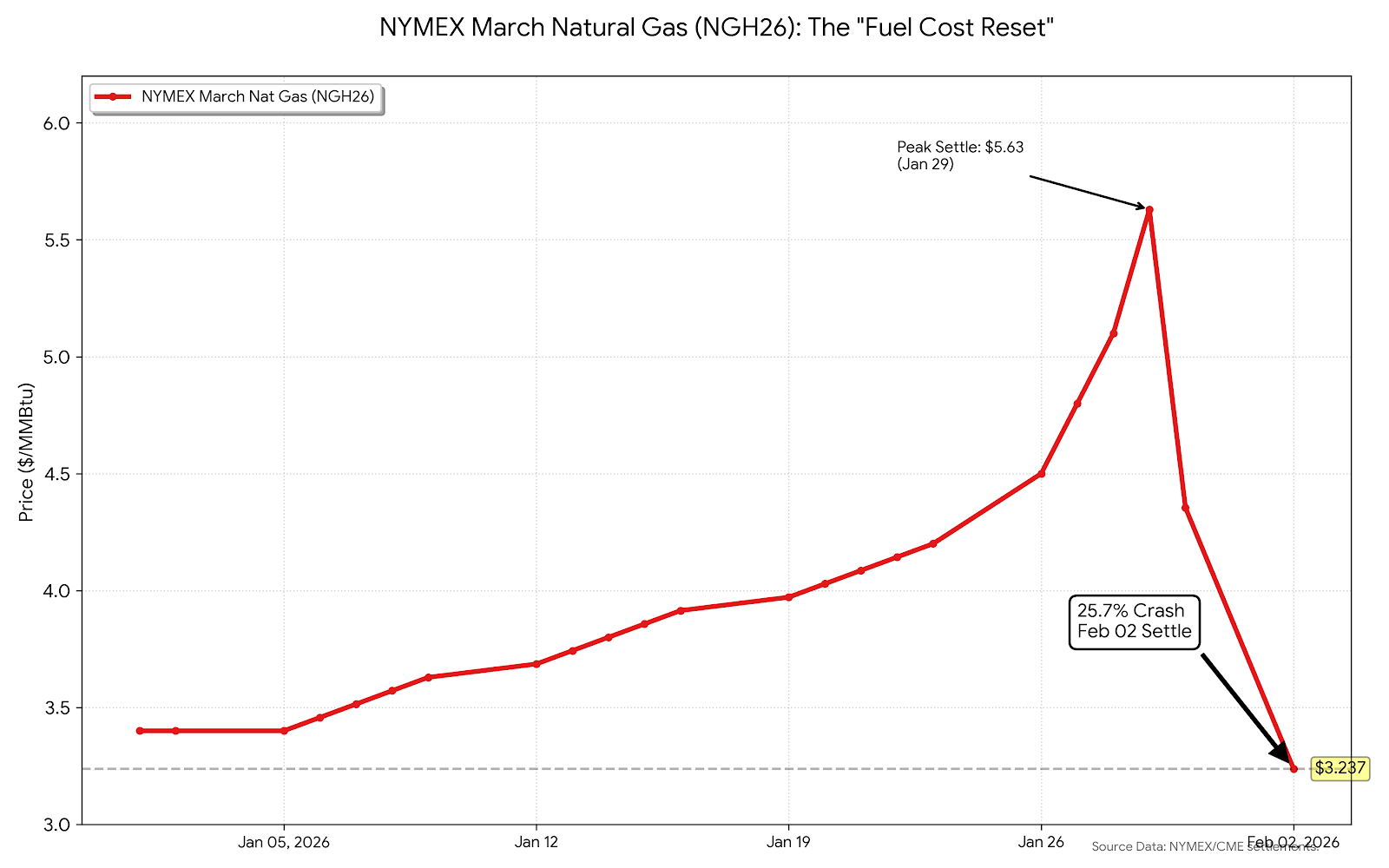

On Monday, February 2, 2026, the March NYMEX natural gas contract (NGH26) settled at $3.237/MMBtu, down $1.117 or 25.65% from Friday’s close of $4.354. This marks the largest single-session percentage decline since December 1995, excluding contract rollover days. Thirty-day close-to-close volatility hit a record 250.7%—for the third consecutive session.

The drivers formed a perfect bear storm: NOAA’s updated 6-to-14-day outlook stripped significant heating degree days from the forecast, projecting above-normal temperatures across more than three-quarters of the Lower 48. Simultaneously, production rebounded to 111.6 Bcf/day as frozen wells thawed far faster than anticipated, erasing the supply premium from Winter Storm Fern almost overnight.

January’s natural gas narrative had been a tale of extreme volatility. The February contract surged to a three-year high of $7.46 on January 28 before expiring. The March contract rallied 11.3% on Friday alone. Then Monday happened. Thirty days of gains, wiped in a single session.

The market is treating this as a weather event. The smart money is treating it as a fuel cost reset.

II. The Tell: $58 Billion Says This Isn’t Oversupply

On the same day that spot gas cratered, Devon Energy and Coterra Energy announced a $58 billion all-stock merger (enterprise value) to create the dominant Delaware Basin operator. Coterra shareholders receive 0.70 Devon shares per share. Management guided to $1 billion in synergies by 2027—double what the Street expected—plus a $5 billion buyback program and a 31% dividend increase upon close.

Hours later, Kimmeridge Energy—a significant shareholder in both companies—issued a public statement supporting the combination while simultaneously disclosing director nominees and demanding Delaware Basin rationalization. Their framing was precise: they want the S-4 filing to demonstrate a competitive process, and they want the combined entity focused on the basin economics that matter over a decade, not the weather that matters over a fortnight.

This is the structural signal that the spot market cannot see. When $58 billion in enterprise value consolidates around a single basin on the same day that basin’s primary commodity crashes 26%, someone is wrong about the demand curve. The spot traders panicked over heating degree days. The M&A desks are underwriting a world where natural gas demand grows 10–20 Bcf/day by 2030—driven not by furnaces, but by data centers.

III. The Thesis: Gas Crash = AI Accelerator

The consensus AI investment framework is built around chip supply. How many H200s can NVIDIA ship? What’s TSMC’s utilization rate? Will the Stargate buildout hit its $500 billion target? These are the right questions—for 2024. The 2026 question is different: Can the grid deliver enough power to run the chips we’ve already ordered?

Data centers are baseload power consumers. They run 24/7/365 at near-constant load. They cannot tolerate intermittency. As coal plants retire and renewable penetration increases, the grid-firming role falls disproportionately to natural gas. This is not a preference—it’s physics. The EIA projects that natural gas consumption for electricity generation will increase steadily through their forecast period, with the Henry Hub spot price rising 33% to approximately $4.60/MMBtu by 2027 as demand growth outpaces supply.

Energy represents 40–60% of data center operating expenditure in key hubs like Northern Virginia (PJM) and Texas (ERCOT). When natural gas swings 25% in a single session, the projected margins for merchant power producers shift violently. For data center operators and utilities negotiating new power purchase agreements right now, today’s crash is a gift—it gives them leverage on the single largest variable cost in their expansion plans.

The Pipeline vs. Reality

Grid operator interconnection queues show approximately 50 GW of data center capacity in various stages of planning—and some analysts project far higher (BCG estimates 95 GW; Goldman Sachs 122 GW by 2030). But planning is not building. Permitting delays, transformer shortages, and grid interconnection timelines mean realistic operational capacity by 2030 is more likely 20–30 GW. That’s still a massive demand driver—enough to require a material increase in gas-fired generation—but precision matters when you’re building an investment thesis around it.

The structural math: if even 25 GW of new data center capacity comes online by 2030, at average power densities of 40–60 MW per facility and 70%+ gas-firming requirements, you’re looking at incremental gas demand of 5–10 Bcf/day. That’s roughly 5–9% of current U.S. production—enough to structurally tighten the market even without LNG export growth, which itself is running at 9% in 2026.

IV. The Transmission Chain: Who Benefits?

The market’s instinct is to look at data center REITs as the primary beneficiaries of lower power costs. The data tells a different story.

The correlation data confirms this framing. Over the October 2025–February 2026 period, daily return correlations between natural gas and the three major data center REITs were essentially zero (EQIX: 0.01, DLR: -0.02, IRM: 0.13). The REITs rose while gas rose, and the REITs rose while gas crashed. They’re structurally decoupled from spot gas volatility—which means the investment opportunity from this crash isn’t in the REITs at all. It’s in the power generation layer: Vistra (VST, closed at $154.26, up over 150% over the past year on AI power bets) and Constellation Energy (CEG, $270.88)—the merchant producers who convert cheap gas into expensive electrons for data centers.

V. The Oversold Producers

The selloff hit pure-play gas producers hard on Monday:

These are pure-play gas names trading on weather sentiment. But their acreage positions them for the structural demand story: LNG exports growing 9% in 2026 and 11% in 2027, data center power demand rising, and coal retirements creating a baseload vacuum. EQT trades at roughly 6x EBITDA against a forward curve that the EIA projects at $4.60/MMBtu by 2027. The Devon/Coterra merger at comparable multiples sets a floor under consolidation value. If the structural demand thesis materializes, these names are trading at a significant discount to forward cash flows.

The contrarian signal is straightforward: gas producers are being sold on cyclical weather fear while the entire industry is positioning for structural demand growth. That’s the definition of a mispricing.

VI. Risks to the Thesis

Weather volatility persists. Late February models still carry some cold risk, and the nat gas market has demonstrated it can swing 25% in either direction on a single forecast revision. The March contract remains the most volatile instrument in commodity markets right now at 250%+ realized vol.

Grid buildout stalls. The 50 GW data center pipeline assumes permitting, transformer supply, and interconnection timelines that may not hold. If realistic capacity is 20–25 GW rather than 30+, the incremental gas demand is proportionally smaller. Regulatory headwinds—particularly around PJM queue reform—could cap the buildout.

Renewables + storage scale faster. If battery costs continue their decline curve and IRA incentives accelerate solar+storage deployment, gas firming demand could soften by 2028–2030. This is a real tail risk, but it’s a 2028+ story—not a 2026 story. The current grid reality is that gas is the only scalable baseload bridge.

LNG export delays. Plaquemines LNG, Corpus Christi Stage 3, and Golden Pass represent the bulk of near-term export capacity additions. Construction delays or regulatory holdups would reduce the demand-side pressure on domestic gas prices.

VII. The Bottom Line

While the entire market watched Palantir beat earnings estimates and jump 7.6% after hours, the more consequential AI trade was happening in the energy complex. A 25.7% crash in natural gas—the fuel that will power the next generation of AI infrastructure—creates a temporary subsidy for every data center, every hyperscaler, and every utility negotiating a power purchase agreement right now.

The spot market sees oversupply. The M&A market sees a $58 billion bet on long-term scarcity. One of them is wrong, and the answer has profound implications for the pace and economics of the entire AI buildout.

The market reads this as weather. The smart money reads it as a fuel cost reset for the next decade of AI infrastructure.

Follow the gas.

DISCLAIMER

This note is provided for informational and discussion purposes only. It does not constitute investment advice, a recommendation, or a solicitation to buy or sell any security. The author and Elm Tree Partners may hold positions in securities mentioned. All data is sourced from publicly available information including NYMEX settlement data, StreetAccount, EIA forecasts, and company filings as of February 2, 2026. Past performance is not indicative of future results. Natural gas futures involve substantial risk of loss.