Executive Summary. U.S. drilling activity has fallen to its lowest sustained levels since the 2020-2021 recovery, with oil rigs at 412, frac spreads at 145, and E&P capital budgets headed for a fourth consecutive year of cuts. Yet crude production hit a record 13.6 million barrels per day in 2025 and natural gas reached 107.4 Bcf/d. This report argues that the rig count collapse is not a bearish signal but the final phase of an industry consolidation that is concentrating production capacity among a shrinking number of scaled, technology-enabled operators with deep low-breakeven inventory. Two mega-deals in the first ten days of February 2026, Devon-Coterra ($58B EV) and Transocean-Valaris ($17B EV), accelerate this trend. Simultaneously, AI-driven demand for gas-fired power generation is creating a secular tailwind for midstream assets, evidenced by Alphabet's $32 billion bond raise, Williams Companies' 10%+ EBITDA CAGR guidance, and Vertiv's 252% surge in data center equipment orders. The value in American energy is migrating from drilling activity to pipeline networks, from fragmented independents to consolidated operators, and from commodity price exposure to contracted throughput. The market has not yet repriced accordingly.

The American oil patch is in the middle of a transformation that the market is mispricing in real time. Investor attention has been consumed by the AI capex arms race. Alphabet just raised $32 billion in bond markets. NVIDIA dominates datacenter hardware. Hyperscaler spending is projected at $650 billion this year. Meanwhile, the energy sector is quietly executing a consolidation play that will reshape domestic production economics for a generation.

The thesis here is not that supply is vanishing. It is not. U.S. crude oil production hit a record 13.6 million barrels per day in 2025. Natural gas output reached a record 107.4 billion cubic feet per day. Both milestones were achieved while drilling activity collapsed. That paradox is the point, and it is the key to understanding where value is migrating across the energy complex.

This report examines five dynamics that are reinforcing each other: the rig count and frac spread decline, the consolidation wave reshaping the upstream sector, the efficiency disconnect that has decoupled production from drilling activity, the AI-gas intersection channeling hundreds of billions in capital toward power-hungry assets, and the downstream market signals corroborating this thesis in real time. Together, they describe a market that has changed but has not yet been repriced.

I. The Data: What the Rig Count and Frac Spread Chart Actually Show

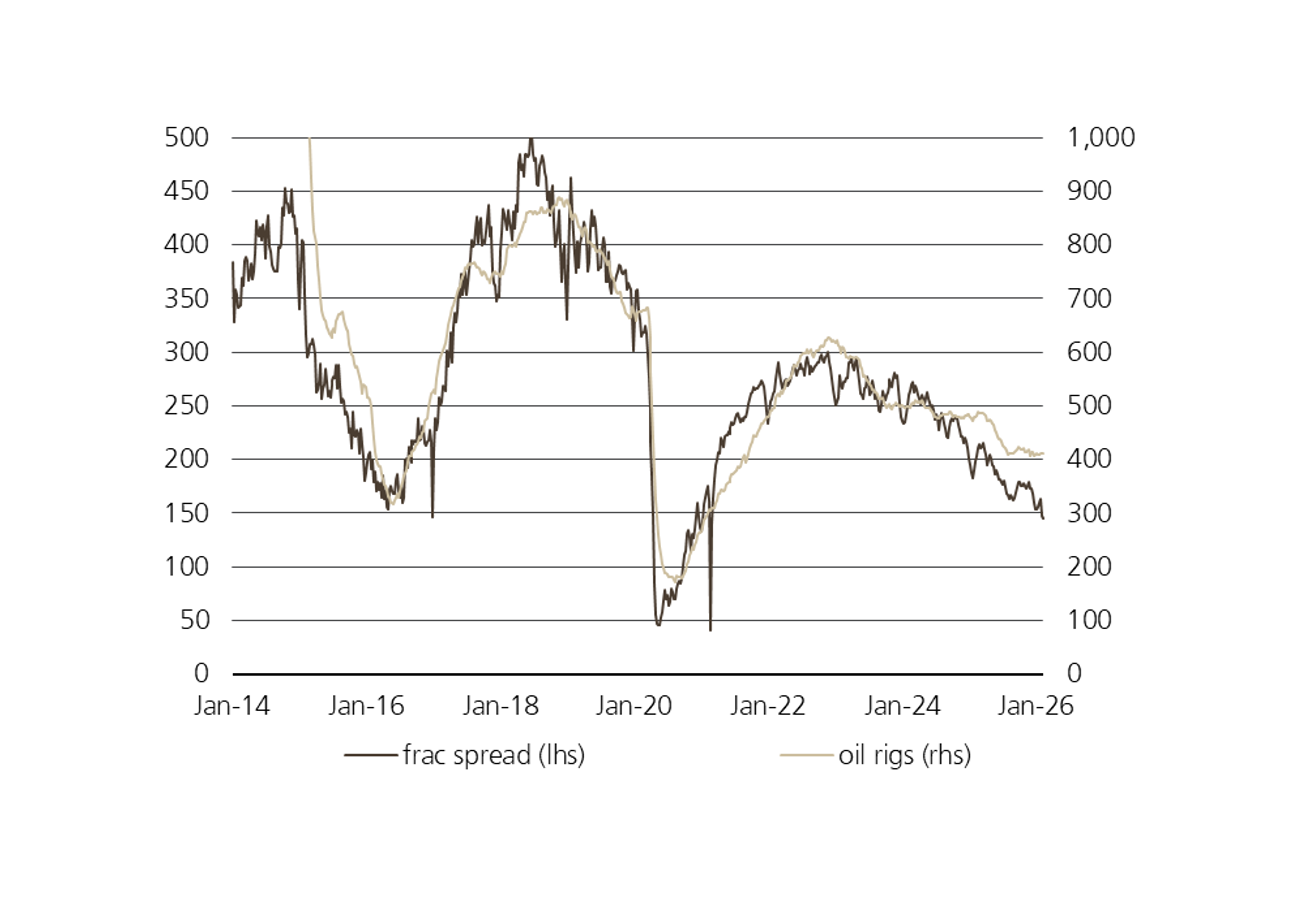

As of the week ending February 6, 2026, Baker Hughes reports the U.S. oil rig count at 412 and total rigs at 551, down 35 rigs or 6% year-over-year. Oil rigs have declined roughly 35% from the post-COVID recovery peak of approximately 625 in late 2022. On the gas side, 130 gas-directed rigs are active, the highest since November but still well below historical norms.

The frac spread count tells a sharper story. Active completion crews have fallen to 145, down roughly 19% from late November 2025 levels of 179 and far below the post-COVID recovery peak near 310 in late 2022. Frac spreads matter more than rig counts. Rigs drill holes. Completion crews are the bottleneck that determines how quickly those holes become producing wells. When the frac spread count falls, operators are not just slowing exploration. They are deferring the capital-intensive process that converts drilled inventory into cash flow.

Both metrics have been in a sustained, correlated downtrend since mid-2022, tracing the steepest and most prolonged decline since the pre-COVID downturn of 2019-2020. The accompanying chart makes this visible. After a sharp recovery from the COVID trough of 2020, both frac spreads and oil rigs peaked in late 2022 and have descended steadily for more than three years.

Current activity levels are the lowest since the 2020-2021 recovery period. But we remain well above the COVID-era trough, when frac spreads bottomed near 50 in May 2020 and oil rigs fell to roughly 170. This is not a crisis. It is a controlled contraction driven by capital discipline, deal-making, and commodity price signals.

And yet production has held at or near all-time highs. The EIA's January 2026 Short-Term Energy Outlook projects U.S. crude production will remain near 13.6 million barrels per day in 2026 before declining modestly to 13.3 million in 2027, marking the first annual decline since 2020-2021. Gas output is projected to rise from a record 107.4 Bcf/d to 108.8 Bcf/d in 2026, even as gas-directed drilling stays subdued.

The rig count fell approximately 7% in 2025, 5% in 2024, and 20% in 2023, as lower U.S. oil prices pushed energy firms toward shareholder returns and debt paydown rather than output growth. Only two of the 22 independent E&Ps tracked by TD Cowen have reported 2026 spending plans as of early February. The signal from the rest is clear enough. Capital expenditures are headed for a roughly 4% cut this year, following a similar reduction in 2025.

The market reads a falling rig count as bearish. We read it as the final act of a consolidation that is concentrating production capacity, raising barriers to entry, and shifting value from the drillbit to the pipeline.

II. The Consolidation Wave: Super-Independents 2.0

The first ten days of February 2026 produced two major transactions. Neither is isolated. They are the latest in a wave building since 2023 that is now reaching a tipping point.

Devon Energy and Coterra Energy

Announced February 2, 2026, Devon's all-stock acquisition of Coterra creates a $58 billion enterprise value shale operator, the largest upstream deal since Diamondback Energy's $26 billion acquisition of Endeavor Energy Resources in 2024 and the first mega-deal of 2026. The equity value is approximately $21.4 billion. Coterra shareholders receive 0.70 Devon shares for each Coterra share, a 12% premium to Coterra's undisturbed mid-January price. Devon shareholders will own roughly 54% of the combined company.

The combined entity will operate as Devon Energy, headquartered in Houston with a continued presence in Oklahoma City. Clay Gaspar, Devon's current President and CEO, will lead the combined firm. Tom Jorden, Coterra's CEO, becomes Non-Executive Chairman. The deal is expected to close in Q2 2026, subject to regulatory and shareholder approvals.

Three elements of the merger presentation stand out.

Start with inventory depth. The combined company holds approximately 750,000 net acres in the economic core of the Delaware Basin, with pro forma Q3 2025 production of 863,000 Boe/d from the Delaware alone. That basin accounts for more than half of combined production and cash flow. Per Enverus data, Devon claims the largest pool of sub-$40/bbl breakeven inventory in the Delaware Basin, with more than 10 years of high-quality drilling locations at current development pace. In a $52/bbl WTI environment, that kind of inventory depth is not just a competitive advantage. It is a survival mechanism.

Then there is the explicit embrace of AI-driven capital efficiency. The merger presentation states that "the combined AI capabilities of both organizations will establish a strong technology platform across subsurface, operations, and enterprise functions" and that "AI-driven optimization will enhance capital efficiency, operational performance, and decision-making at scale." Management is telling the market something important here. Scale enables technology deployment. Technology deployment enables production maintenance with fewer capital dollars. The combined Devon does not need more rigs. It needs better data applied to fewer, higher-quality wells.

Finally, the gas mix. Combined pro forma production exceeds 1.6 million Boe/d, split 34% oil, 44% natural gas (4.3 Bcf/d), and 22% NGLs. A gas-heavy commodity mix was once viewed as a liability in an oil-focused market. Management is reframing it as a strength. As U.S. gas demand rises with power generation and data center growth, Devon-Coterra becomes a major supplier of associated gas into the Permian midstream system at the moment when that gas has a secular demand tailwind behind it. An important distinction, though: the gas revenue at $3-4/MMBtu is optionality, not a base case earnings driver. Devon-Coterra's economics are built on oil breakevens, and the gas upside is a free call on the AI-power demand thesis materializing over time.

The deal targets $1.0 billion in annual pre-tax synergies by year-end 2027 through capital program optimization, operating margin improvements, and streamlined corporate costs. Planned shareholder returns include a $0.315/share quarterly dividend and a repurchase authorization expected to exceed $5 billion.

Transocean and Valaris

One week later, on February 9, 2026, Transocean announced its $5.8 billion all-stock acquisition of Valaris, creating a $17 billion enterprise value offshore drilling company. This is a different kind of deal, operating in different basins with different economics, but it reflects the same underlying logic. Scale for survival. Efficiency through combination. Financial positioning for a cyclical recovery.

The combined fleet totals 73 rigs, including 33 ultra-deepwater drillships, nine semisubmersibles, and 31 modern jackups, with exposure across the Gulf of Mexico, Brazil, West Africa, the Middle East, and the North Sea. Combined contract backlog sits at approximately $10 billion. Management has identified more than $200 million in cost synergies on top of Transocean's existing $250 million cost-reduction program and targets a leverage ratio of approximately 1.5x within 24 months of closing, a dramatic improvement for a sector historically weighed down by debt.

This deal follows Noble Corporation's acquisition of Diamond Offshore in 2024 and ADES' merger with Shelf Drilling in 2025, marking the third consecutive year of meaningful offshore drilling consolidation. The offshore sector, which nearly died after the 2014 oil price collapse and a subsequent wave of bankruptcies, is reconstituting itself into a smaller number of financially disciplined, high-specification operators built to capture rising dayrates as global activity strengthens. While the offshore and onshore stories are driven by different economics, they reinforce each other. Offshore supply discipline reduces global production growth expectations, which supports the pricing environment that onshore operators need to maintain capital discipline and continue high-grading their drilling programs.

The Broader Timeline

These deals cap a three-year consolidation wave that has fundamentally restructured the American energy landscape.

In 2023, ExxonMobil acquired Pioneer Natural Resources for roughly $60 billion, securing a dominant Permian/Midland Basin position, and Chevron announced its $53 billion acquisition of Hess Corporation to access Guyana deepwater assets. In 2024, Diamondback acquired Endeavor for $26 billion, consolidating the Midland Basin, while ConocoPhillips took Marathon Oil for $17 billion and Noble absorbed Diamond Offshore. M&A activity slowed in 2025 as lower oil prices and tariff uncertainty weighed on deal appetites, though ADES and Shelf Drilling merged on the offshore side. Then in the first ten days of 2026, Devon-Coterra and Transocean-Valaris brought the wave roaring back.

One analyst characterized the Devon-Coterra deal as "thinning out the middle class of energy stocks," and that captures it well. The mid-cap independents, companies running 50,000 to 150,000 net acres and producing 100,000 to 300,000 Boe/d, are being absorbed. What remains will be a smaller group of scaled operators with the balance sheets, inventory depth, and technology platforms to maintain production through commodity cycles without expanding drilling activity.

In some ways this mirrors the consolidation of the late 1990s, but the motivating logic has changed. Today's mergers are driven by the need to secure a decade or more of Tier 1 drilling inventory at sub-$40/bbl breakevens, not by a desire for global geographic expansion.

III. The Efficiency Paradox: Record Output on a Shrinking Rig Fleet

The conventional reading of a falling rig count is simple. Less drilling means less future supply, which means higher future prices. The current environment defies that logic.

Between 2022 and 2026, the U.S. oil rig count fell roughly 35% from its post-COVID peak. Over that same period, crude production rose from approximately 12.0 million barrels per day to a record 13.6 million. More output from dramatically fewer rigs. Understanding why requires looking at three reinforcing drivers.

Longer lateral wells have changed the economics of every well drilled. The industry has shifted decisively toward extended-reach laterals of two to three miles, made possible by contiguous acreage positions that consolidation has assembled. Every additional 1,000 feet of lateral length increases estimated ultimate recovery per well while spreading fixed drilling costs over greater production volumes. The Devon-Coterra deal is engineered for exactly this. Overlapping Delaware Basin acreage blocks create the contiguous positions required for longer laterals, tighter development spacing through "cube development" across multiple geological intervals, and lower per-well costs. Acreage swaps and boundary-line optimization between merged operators are among the most immediate sources of capital efficiency in these deals.

High-grading has done the rest. Operators have retreated to their highest-return drilling locations, the sub-$40 breakeven Tier 1 inventory that the Devon-Coterra merger presentation highlights. Marginal locations have been deferred or abandoned. In a $52/bbl WTI environment, a well that breaks even at $60 destroys value. A well that breaks even at $35 generates substantial free cash flow. Rigs are not falling because operators cannot drill. Rigs are falling because operators are choosing to drill only the best wells.

Data-driven completion optimization adds another layer. Real-time analytics, machine learning-driven frac design, and predictive well performance models are incrementally improving recovery factors. Devon-Coterra's merger presentation cites AI-driven optimization across subsurface, operations, and enterprise functions as a core capability of the combined platform. The gains are meaningful but not miraculous, on the order of 10 to 30 percent per well over several years based on reported drilling productivity improvements. Applied across thousands of wells by scaled operators, though, the cumulative effect is production resilience even as rig activity falls. The EIA's Drilling Productivity Report has documented rising new-well oil production per rig across the Permian, corroborating this with granular data.

All of this has produced an industry that can sustain current production with fewer rigs but has quietly consumed much of its buffer. The EIA's January 2026 outlook makes the tension plain. Breakeven prices in the Permian's Midland and Delaware Basins now average $61 to $62 per barrel per the Dallas Fed Energy Survey. Forecast WTI prices of $52 per barrel for 2026-2027 sit well below that threshold. But those averages obscure the distribution. The consolidated players are pulling their effective breakevens well below the basin average through high-grading and technology deployment, while the remaining independents are stuck at or above it. The average is becoming less representative of the operators who actually drive production.

This creates a selective squeeze. Operators with sub-$40 breakeven inventory can sustain and grow production profitably at $52 oil. Operators with $60-plus breakevens cannot. The rig count is falling not because of industry-wide distress but because of culling. The consolidation and the rig decline are not separate stories. They are the same story.

If prices stay depressed, the rig count keeps falling. But unlike prior downturns, the operators who survive are the consolidated, technology-enabled, sub-$40 inventory holders who can absorb the pressure. Everyone else exits through M&A, asset sales, or attrition.

One caveat worth stating plainly. Devon-Coterra's 10-plus years of sub-$40 inventory is exceptional, not representative. Most operators, including many recently consolidated ones, do not have that kind of cushion. If WTI sustains at $52 for multiple years, even Tier 1 inventory gets consumed, and the industry eventually faces a replacement problem that no amount of efficiency optimization can solve. The consolidation thesis does not assume permanently low prices. It assumes the companies with the deepest inventory and lowest breakevens will be the last ones standing when the cycle turns, and that their relative positioning improves with every quarter that prices stay below the industry-average breakeven. That dynamic is what makes the current environment a consolidation accelerant rather than an industry-wide death sentence.

IV. The AI-Gas Tie-In: Following the Capital

The second dimension of this shift is the intersection of AI capital spending and natural gas, funded at a scale that demands attention from anyone in the energy markets.

The Scale of AI Capital Formation

Alphabet's multi-currency bond issuance this week is the most visible signal. On Monday, February 10, the Google parent raised $20 billion in its largest-ever U.S. dollar bond sale, exceeding the $15 billion initially planned after attracting an order book north of $100 billion. The next day, Alphabet issued debut sterling and Swiss franc tranches, with the sterling offering including a 100-year bond, the first century bond from a technology company since Motorola in 1997. Total proceeds approached $32 billion in under 24 hours.

The borrowing reflects Alphabet's 2026 capex guidance of $175 to $185 billion, nearly double its 2025 spend and roughly 50% above the market expectation of $119.5 billion. Alphabet is far from alone. Morgan Stanley estimates hyperscaler borrowing will reach $400 billion in 2026, more than double the $165 billion borrowed in 2025. Oracle raised $25 billion the prior week in a bond offering that attracted a record $129 billion in orders. Combined 2026 capex forecasts for the four major U.S. cloud providers (Amazon, Google, Meta, and Microsoft) are expected to reach approximately $650 billion, a figure that exceeds the GDP of Israel.

This capital is building data centers. Data centers consume power at industrial scale.

The Gas-Power Link

Natural gas remains the dominant marginal fuel source for new U.S. electricity generation over the near and medium term, despite growing investment in nuclear alternatives. Microsoft-Constellation's Three Mile Island restart, Google's Kairos small modular reactor partnership, and Amazon-Talen Energy all represent serious long-term commitments to nuclear power. But nuclear projects face multi-year permitting and construction timelines, and SMRs remain largely pre-commercial. Renewable capacity additions are significant but intermittent and face their own permitting, interconnection, and grid integration hurdles.

That is the right framing for the next five to seven years. Beyond that window, the calculus could shift. If this administration or its successor streamlines nuclear permitting, and if SMR technology proves commercially viable at scale, the terminal value of long-duration gas contracts could face compression. Hyperscalers are already hedging this possibility. Google, Microsoft, and Amazon are investing in nuclear precisely because they do not want permanent dependence on gas-fired generation. The gas-as-bridge-fuel thesis is strong on a five-to-ten-year horizon, but the bridge has a far side, and the nuclear players are building toward it.

The EIA projects electricity demand growth of 2.4% in 2025 and 2.6% in 2026, growth rates not seen in decades, driven by data center and cryptocurrency mining expansion concentrated in Texas and the broader West South Central region. Natural gas-fired generation is the swing resource meeting this incremental demand. The pathway from AI capex to gas pipeline throughput is straightforward. Hyperscaler capital builds data centers. Data centers need electricity. Electricity comes from gas-fired plants. Gas-fired plants need pipeline delivery. Each link in this chain has alternatives that will grow over time. But over the next five to seven years, gas is the highest-probability marginal fuel for AI-driven power demand.

A reasonable objection is that gas supply may not tighten even if demand accelerates. Associated gas from Permian oil wells continues to flow regardless of gas-directed drilling activity, and 5 Bcf/d of new LNG export capacity coming online in 2025-2026 through Plaquemines LNG and Corpus Christi Stage 3 will pull additional supply into the market. The EIA projects gas storage inventories of 3,380 Bcf by year-end 2025 and 3,020 Bcf by year-end 2026, levels that do not suggest imminent scarcity. Indeed, if oil production holds near records, the associated gas that comes with it could keep prices suppressed even as demand grows, compressing E&P gas margins even while midstream volumes soar.

The midstream thesis accounts for this. It does not depend on a gas supply squeeze. It depends on the observation that incremental demand for pipeline throughput, driven by power generation and LNG exports, is growing faster than incremental pipeline capacity can be built. The bottleneck is not molecules. It is infrastructure.

Williams Companies and the Pipeline Moat

Williams Companies, whose Transco pipeline system is the largest-volume interstate natural gas pipeline in the United States, is the most direct beneficiary of this dynamic. At its February 10 Analyst Day, Williams outlined a five-year EBITDA compound annual growth rate exceeding 10% through 2030, citing AI and data center demand, LNG export growth, and industrial reshoring as secular volume growth drivers.

Wells Fargo responded by raising its price target to $80 from $71 on February 11, maintaining an Overweight rating and noting that approximately 8% of the projected growth is already "locked in" from projects that have reached final investment decision. RBC Capital set a new target of $78. Williams reported Q4 2025 earnings per share of $0.55, slightly below the $0.57 consensus, but revenue of $3.20 billion above the $3.10 billion consensus, and guided to full-year 2026 EPS of $2.20 to $2.38.

The link between Alphabet's century bond and Williams' pipeline throughput is not direct. It is a probabilistic chain. But the probability is high and getting higher as each quarter brings additional data center capacity online in gas-dependent regions. If drilling activity stays constrained while gas demand accelerates, operators with existing pipeline infrastructure and contracted capacity become increasingly scarce and valuable. New pipeline construction faces permitting timelines of three to five years or longer. Existing midstream infrastructure cannot be replicated on the timeline that AI demand requires.

A note of intellectual honesty on the permitting point, because it cuts both ways. The same regulatory friction that protects Williams' existing asset base from new competitive entry could also delay its own expansion projects. Williams' 10%+ EBITDA CAGR depends partly on bringing new capacity online, and permitting delays could push the outer years of that growth curve to the right. The distinction that matters is that roughly 8% of the projected growth has already cleared permitting through FID projects. The incremental 2% carries permitting risk. That risk is real but bounded for Williams, while it is an existential barrier for any would-be competitor starting from scratch. Permitting friction is asymmetric. It is a modest headwind for the incumbent and a brick wall for the entrant.

Midstream companies with gas-focused pipeline networks and exposure to data center power demand corridors may be trading at a discount to their forward value, one that will narrow as the AI-gas demand curve shows up in utility interconnection queues and gas-fired generation contracts.

V. Downstream Signals: What the Week's Hidden Movers Tell Us

Week of February 3-11, 2026: Key Market Signals

Several data points from the past week reinforce the thesis from different angles.

Vertiv Holdings surged approximately 24% on February 11, the day of this writing, after reporting Q4 2025 results. The data center cooling and power management company posted organic orders up 252% year-over-year, a book-to-bill ratio of 2.9x, and a record backlog of $15 billion, up 109% year-over-year. Full-year 2026 guidance calls for net sales of $13.25 to $13.75 billion, implying organic growth of 27 to 29 percent, with adjusted diluted EPS of $5.97 to $6.07. CEO Giordano Albertazzi pointed to "significant growth in orders, sales, margins and cash" as evidence of the company's ability to scale while maintaining operational discipline.

Vertiv matters here because it is a direct, real-time readout of physical AI buildout demand. When companies building data centers are ordering cooling and power equipment at 2.9 times their current revenue rate, the electricity and gas demand to run that equipment follows on a lagged basis. The Americas region and hyperscale/colocation customers were the primary drivers of order strength, and those happen to be the geographies and customer segments most dependent on gas-fired power generation.

Lumen Technologies rallied approximately 29% on February 6 after CEO Kathleen Johnson purchased $500,000 of stock on the open market at $6.35 per share, reversing a 21% post-earnings decline. The purchase followed Q4 results that beat operating earnings expectations, with EPS of $0.23 versus a consensus of negative $0.21, despite a $2 million net loss. Lumen has been pivoting from legacy telecom to AI fiber network provider, backed by over $13 billion in contracts with hyperscalers including Microsoft and Meta for its Private Connectivity Fabric.

Lumen's relevance to the energy thesis comes down to an analogy. The company owns fiber infrastructure that is difficult to replicate and increasingly essential to AI operations, just as Williams owns pipeline infrastructure that is difficult to replicate and increasingly essential to gas delivery. Both are "pipes" companies. One carries data, the other molecules. Both are seeing their existing asset bases revalued by AI-driven demand. Johnson's open-market purchase at a post-earnings low was a confidence signal, and the market validated it with a nearly 30% move in a single session.

TotalEnergies reported a 17% decline in full-year 2025 net income to $13.1 billion, reflecting a 15% decline in oil prices year-over-year. Q4 2025 net income fell 26% to $2.9 billion. But the company showed resilience. Cash flow from operations held stable at $7.2 billion in Q4 despite a $5/bbl decline in realized oil prices, and return on average capital employed of 12.6% was the highest among the supermajors for the fourth consecutive year.

At the same time, TotalEnergies assumed full operational control of the Zeeland refinery in the Netherlands. Early press reports created confusion on this point, so a clarification matters. TotalEnergies has not acquired Lukoil's 45% ownership stake. CEO Patrick Pouyanné confirmed on February 11 that the company took over operations under a temporary arrangement, supplying all crude, managing the plant, and taking its output, while Lukoil seeks a buyer for its interest. U.S. Treasury sanctions on Lukoil, imposed in October 2025, prompted the Russian company to launch a sale of its international assets, initially valued at approximately $22 billion. The Zeeland arrangement stays in place until a buyer emerges. Lukoil's broader global asset sale to Carlyle is pending OFAC approval.

Geopolitics is forcing asset transfers into financially stronger hands, further concentrating the refining and production base among a smaller number of well-capitalized operators. This is consolidation by regulatory force rather than strategic choice, but the result is the same. Fewer, larger, more efficient entities controlling a greater share of global capacity.

VI. What the Market Is Missing

The conventional framing mistakes activity for value. A falling rig count does not mean the energy sector is in retreat. Paired with sustained record production, it is the signature of an industry that has fundamentally restructured. The market has not adjusted its valuation frameworks to reflect this.

The operators emerging from this consolidation wave do not need more rigs. The combined Devon-Coterra, with more than 10 years of sub-$40 inventory and AI-driven capital optimization across 750,000 net Delaware Basin acres, can sustain and grow production profitably at oil prices that would bankrupt a mid-cap independent. The merged Transocean-Valaris, with $10 billion in offshore backlog and a path to 1.5x leverage, can capture rising dayrates from a fortress balance sheet. These companies were not built to wait for a commodity price recovery. They were built to generate free cash flow and shareholder returns through the cycle.

Value is migrating. Away from the drillbit and toward the pipeline. Away from the rig floor and toward the algorithm. Away from the fragmented independent and toward the consolidated operator. The companies positioned where gas infrastructure meets AI-driven demand growth, Williams Companies most directly, but also the scaled E&Ps with significant associated gas production and the midstream operators connecting Permian supply to Gulf Coast demand centers, represent an asymmetry the market has not fully appreciated. Everyone is watching the next NVIDIA earnings print. Fewer people are watching the frac spread count.

Consider what happened in a single week. Alphabet borrowed $32 billion at near-sovereign credit terms to build AI data centers. Williams outlined a 10-plus percent EBITDA CAGR driven in significant part by the gas demand those data centers will generate. Vertiv reported a 252% surge in data center equipment orders. Devon and Coterra combined to lock in a decade of low-breakeven, gas-rich inventory. And the frac spread count fell to 145, signaling that the industry is not ramping up supply to meet this emerging demand but rather consolidating and high-grading its way toward scarcity.

By the time the rig count stabilizes, and it will, likely in the low-to-mid 400s for oil rigs absent a meaningful price recovery, the domestic production base will be controlled by a substantially smaller number of companies. Each will operate with greater capital efficiency, lower breakevens, and deeper inventory than the fragmented industry of five years ago. The barriers to new entry will be materially higher.

The ghost rigs are not a warning. They are a signal. The consolidation is the trade.

DISCLAIMER

This note is provided for informational and discussion purposes only. It does not constitute investment advice, a recommendation, or a solicitation to buy or sell any security. The author and Elm Tree Partners may hold positions in securities mentioned. All data is sourced from publicly available information including Baker Hughes rig count data, EIA forecasts, company filings, merger presentations, and Wall Street research as of February 11, 2026. Past performance is not indicative of future results. Energy equities and commodities involve substantial risk of loss.