II. The Anchor Exodus and Retail Collapse

A. AT&T’s Departure

On January 5, 2026, AT&T CEO John Stankey confirmed via employee email that the Fortune 50 company would relocate its global headquarters to 5400 Legacy Drive in Plano—the former Electronic Data Systems site owned by NexPoint. The 54-acre horizontal campus will consolidate the company’s three largest DFW locations (Central Dallas, Plano, Irving) under one roof, with partial occupancy targeted for late 2028.

The impact metrics are sobering. A 2025 Boston Consulting Group study commissioned by Downtown Dallas Inc. estimated that AT&T’s exit would trigger a 30% decline in downtown property values, representing a $2.7 billion drop and a $62 million annual loss in property tax revenue for the City of Dallas. AT&T’s Discovery District—an entertainment campus opened in 2021 with a two-story food hall, lawn seating, and a multi-story outdoor screen—faces an uncertain future; the company has declined to comment on its plans for the property or whether it will retain any downtown presence. AT&T owns three buildings downtown and leases the 37-story Whitacre Tower through 2031. As a practical matter, AT&T will remain a physical presence in the CBD for several more years—but the psychological signal of a Fortune 50 headquarters relocation is immediate, and the company’s silence on its downstream real estate strategy suggests a full disposition is at least plausible. If AT&T completely vacated, CoStar estimates the CBD vacancy rate would rise to 33.7%—surpassing Seattle for the highest central business district vacancy rate in the country.

Mayor Eric Johnson: “As we worked to retain AT&T, it became clear that its current leaders preferred a large horizontal, suburban-style campus rather than the skyscrapers that define our city center.”

The subtext: this was not a failure of incentives or negotiation—it was a structural mismatch between what a 21st-century employer wants and what legacy downtown can deliver. Internal AT&T data showed a majority of employees would have a shorter commute to Plano, reflecting DFW’s continued northward suburban migration—Collin County has grown from 264,000 residents in 1990 to 1.25 million in 2024.

B. The Neiman Marcus Saga

The flagship Neiman Marcus at Main and Ervay streets has been a symbol of Dallas culture since 1914. In February 2025, Saks Global (which acquired Neiman Marcus for $2.7 billion) announced the store would close on March 31, 2025, citing the expiration of a 99-year ground lease. The City of Dallas, Todd Interests, Downtown Dallas Inc., and the Dallas Economic Development Corporation scrambled a 24-hour intervention: the Slaughter family landowner donated the ground to the City. Saks reversed course—partially—keeping the store open through the 2025 holiday season, then into 2026 while “productive conversations” with the City continue about “reimagining” the space. Potential proposals include a curated luxury retail experience, art exhibitions, a fashion and event center, and a design incubator.

Adding turbulence, Saks Global filed for Chapter 11 bankruptcy on January 14, 2026, carrying more than $2 billion in acquisition debt. Richard Baker stepped down as CEO, replaced by former Neiman Marcus head Geoffroy van Raemdonck, who is leading the restructuring. All 36 Neiman Marcus locations, including the downtown flagship, remain open under $1.75 billion in debtor-in-possession financing—but the long-term viability of a luxury department store in a CBD with 33%+ vacancy and declining foot traffic is an open question. While all locations remain operational during restructuring, the flagship’s luxury viability in a high-vacancy CBD remains precarious. On January 29, Saks Global announced it would shutter 57 of its 69 Saks OFF 5TH locations and all five remaining Neiman Marcus Last Call stores—eliminating approximately 5,000 positions and effectively exiting the off-price business. The company framed the move as a pivot to “Pure Luxury,” concentrating DIP resources on its core full-price banners (Saks Fifth Avenue, Neiman Marcus, Bergdorf Goodman). The strategic logic is clear, but the speed and scale of the cost-cutting underscores the severity of Saks Global’s financial distress—and raises the question of whether underperforming full-price locations, including a flagship in a high-vacancy CBD, may face scrutiny in subsequent footprint optimizations.

Critically, the Slaughter family land donation means the City of Dallas is now the ground landlord—making the municipal government the primary stakeholder in keeping this retail anchor alive. The City’s interest is not merely sentimental: an empty Neiman Marcus at Main and Ervay would create a “broken window” effect on Main Street at the worst possible moment, reinforcing the ghost-town narrative precisely when the City is trying to attract replacement tenants and conversion capital. The City’s leverage as landlord, however, also creates optionality: if Saks cannot sustain operations, the City controls the ground for potential reuse or re-tenanting without the complications of a private ground lease.

Meanwhile, Saks plans a $100 million renovation of the NorthPark Center location seven miles north, further signaling where the company sees its Dallas future. The Willow Bend location in Plano was sold and is slated to close by January 2027.

C. The Secondary Effects: The “Ghost Town” Problem

The departures are not isolated. K&L Gates moved from the 60-story Comerica Bank Tower to the Harwood District in December 2025. Comerica’s lease in its namesake tower expires in 2028—and the Fifth Third / Comerica merger became effective on February 2, 2026, creating the ninth-largest U.S. bank with $294 billion in assets. Comerica branches will continue operating under the Comerica brand through Q3 2026, when full system and brand conversion to Fifth Third is expected. Fifth Third CEO Tim Spence has outlined plans for 150 new de novo branches in Texas by 2030, but the combined bank’s downtown Dallas footprint is an open question: Fifth Third’s stated strategy emphasizes “density in high-growth markets”—language that may favor newer suburban floorplates over a 1980s-era namesake tower with a 2028 lease expiration. Comerica Tower’s naming rights are also in play, with changes possible as soon as 2027. If Fifth Third consolidates into a smaller, modern footprint elsewhere in DFW—as its strategy language suggests—the 60-story tower (one of downtown’s seven firms with 1,000+ employees) would add another major vacancy to the CBD’s already strained inventory. Parkland Hospital and Health System (2.7 million square feet occupied) and the U.S. General Services Administration (1.2 million+ square feet) now represent outsized shares of downtown tenancy—institutional anchors with limited spillover to street-level retail.

The cumulative CBD and urban submarket move-outs total 5.1 million square feet since end of 2019. Downtown business owners describe an erosion of daytime foot traffic and spending. Safety perceptions have compounded the problem: between 2019 and 2024, downtown office vacancy surged from 21.3% to 27.1%. In response, the City increased officers assigned to the downtown business district to a ten-year high of 130. DDI quality-of-life metrics have trended positive since late 2024, and downtown’s residential population has grown to about 15,000 in more than 10,000 apartment units—a base that DDI argues creates a “self-policing” dynamic over time.

III. Case Study: The Harwood Center (1999 Bryan St.)

The Harwood Center crystallizes every pathology afflicting downtown Dallas office assets. Built in the early 1980s, the 36-story, ~735,000-square-foot tower went to auction via RealINSIGHT Marketplace in October 2025—and did not sell.

A. The Distress Lifecycle

The property’s default history traces back to 2021, when the previous New York-based ownership partnership defaulted on the mortgage. The asset reverted to the lender and is now held by COMM 2014-UBS5, a CMBS trust, with CWCapital serving as special servicer. SEC filings from early 2026 reveal the trust “opted not to let go of the property” after the auction—a decision that likely reflects the gap between what the market would pay and the face value of the remaining debt. The special servicer’s terse explanation: “The decision was made not to proceed with a trade.”

Investment sales brokers Mike Hardage, Stephen Simon, and Steve Pumper of Transwestern marketed the property and did not respond to press inquiries.

B. Occupancy and Valuation

As of September 2025, occupancy stood at just 46%. The Dallas Central Appraisal District estimates the building’s value at $45.7 million for property tax purposes—though such assessments commonly trail market value. The tower’s major tenants include Jacobs (world headquarters), Omnicom Management, and the General Services Administration.

The Jacobs Risk: If Jacobs were to downsize or depart, the building’s effective occupancy could plummet to 10–20% virtually overnight, rendering it functionally obsolete. As a global engineering firm with options, Jacobs’s long-term commitment to this specific asset is not assured.

C. The Ground Lease Complication

Perhaps the most significant impediment to any reuse or repositioning is the building’s fragmented land ownership. Colliers is marketing a 0.16-acre sliver of land beneath the building for separate sale, and the property has two additional ground leases (all expiring September 1, 2077). Ground leases are investor kryptonite in a high-interest-rate environment: buyers do not own the underlying land, which makes conventional financing extremely difficult and constrains the range of redevelopment options.

The Severability Problem (“Ransom Parcel”): The difficulty is not merely that the building sits on leased land—it is that the land is severed across multiple owners. A lender cannot foreclose on the entire functional asset without the cooperation of each ground lessor. The 0.16-acre sliver, marketed independently, creates a classic “ransom parcel” dynamic: whoever controls that sliver has effective veto power over any whole-building transaction or redevelopment. Any acquirer would need to either consolidate all three leases or negotiate buyouts with each landowner—a costly, uncertain, and potentially adversarial process. This fragmentation is the most likely explanation for the failed auction: no rational buyer will underwrite a $50+ million repositioning when a sub-quarter-acre parcel owner can hold the entire project hostage.

D. Conversion Potential

Existing zoning allows conversion to residential, hotel, and mixed-use applications. However, the 1980s-era “deep core” floorplate presents substantial physical challenges: moving plumbing, HVAC, and electrical infrastructure for residential conversion on a building of this age and scale would require significant capital expenditure—before accounting for ground-lease complications. The property has not been renovated since 1996. Buildings must be larger than 20,000 square feet and have high vacancy to be considered for the City’s conversion-friendly framework, which this asset satisfies—but the ground lease structure is the deal-killer.

IV. The Office Market: Metrics of Distress

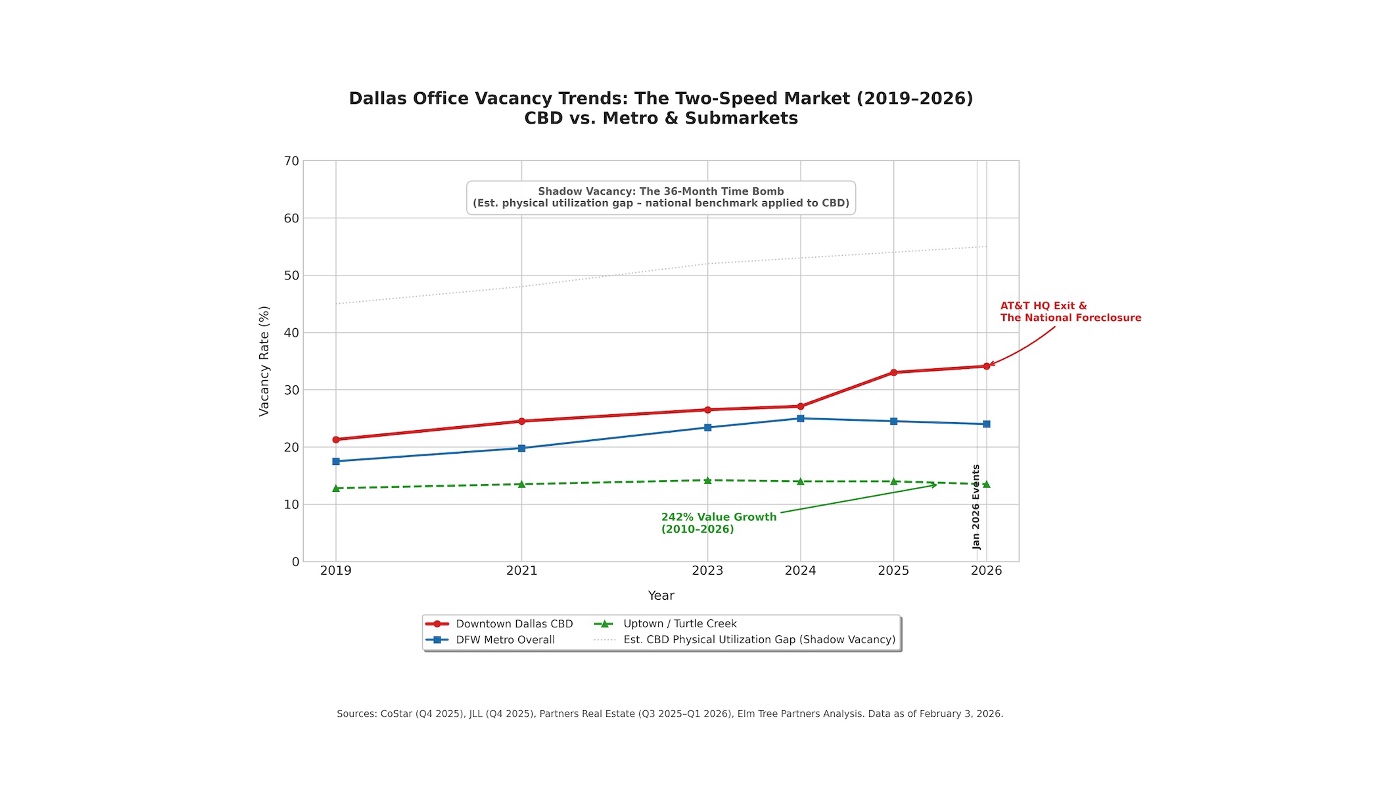

A. The Two-Speed Market

The defining feature of the DFW office market in 2025–2026 is its bifurcation. At the metro level, DFW posted positive annual net absorption for the first time since 2019 (1.3 million square feet per JLL’s Q4 2025 report), Class A trophy assets captured 70% of leasing activity, and asking rents hit a record high at $32.94/sf. But downtown is being left behind.

|

Market / Submarket

|

Vacancy Rate

|

Key Trend

|

|

DFW Metro (Overall)

|

~17.8% (CoStar) / 27.2% (JLL)

|

Positive absorption; vacancy peaked

|

|

Downtown Dallas CBD

|

~33–34%

|

Worsening; AT&T exit pending

|

|

Stabilized Trophy Class A (DFW)

|

~12.7%

|

Tightening; limited options >50K sf

|

|

Lower-Tier Class A (DFW)

|

~28.2%

|

Negative absorption continues

|

|

Uptown / Turtle Creek

|

Significantly lower than CBD

|

242% property value increase since 2010

|

|

Collin County (New Product)

|

~8.0%

|

Resident base up 45% since 2010

|

Sources: CoStar, JLL Q4 2025, Cushman & Wakefield Q1 2025, Bradford Companies, Partners Real Estate. CBD figures reflect post-AT&T announcement estimates; pre-January 2026 snapshots reported lower due to narrower scope and inventory definitions not yet incorporating AT&T and National impacts. Q4 2025 and Q1 2026 reports pending full AT&T impact incorporation.

Late 1990 was the last time office vacancy rates in downtown Dallas were lower than the regional average. Downtown’s office inventory has shrunk 20% over the last 35 years—from nearly 43 million square feet in 1990 to 34.3 million square feet in 2025. In North Texas as a whole, which has seen a nearly 70% increase in office space over that period, the vacancy rate was 17.8% at end of 2025, down from 19% in 1990.

Shadow Vacancy—The Numbers Behind the Numbers

The vacancy figures above measure contractual vacancy—space where no lease is in effect. They do not capture physical vacancy: space that is leased but largely unoccupied due to hybrid and remote work arrangements. National data from CommercialCafe and Yardi Research pegs physical office occupancy rates in the 50–55% range across major U.S. markets, and there is no reason to believe downtown Dallas outperforms that benchmark. Many firms in towers like Comerica Bank Tower (now Fifth Third) and JPMorgan Chase Tower are still paying rent but have a fraction of their pre-COVID headcount physically present on any given day. The practical implication: on a Tuesday or Wednesday (peak in-office days), actual physical utilization of leased CBD space is likely in the 40–50% range; on Mondays and Fridays, it may approach single digits in some buildings.

This is not merely an aesthetic problem—it is a 36-month financial time bomb. Shadow vacancy represents a pipeline of future contractual vacancy. As these leases expire over the next three years, tenants will right-size to their actual utilization, and many will not renew at current square footage levels. The CBD’s contractual vacancy rate of ~33–34% is therefore a lagging indicator: the true demand picture, measured by physical occupancy, suggests that the equilibrium vacancy rate—once all current leases have cycled through renewal—could settle materially higher. This dynamic also depresses the street-level retail and restaurant ecosystem that depends on daytime foot traffic: a building that is 70% leased but only 35% occupied generates roughly half the lunch-hour spending of a fully utilized building. The Cushman & Wakefield team believes a “majority of tenants have already downsized or rightsized,” but that assessment applies to the metro’s trophy product—not specifically to the CBD’s aging commodity towers, where the right-sizing wave is still building.

B. Flight to Quality

The DFW market’s flight to quality is extreme. Class A trophy buildings in Uptown, the Design District, and Far North Dallas are competing for a shrinking pool of creditworthy tenants—and winning. Asking rents in these submarkets have reached $32.94/sf on average, while commodity Class A and Class B space in the CBD is losing tenants at an accelerating rate. The result is a two-tier market: the top third of buildings are essentially full; the bottom third are zombies.

Dallas’s 15 tallest towers, all located downtown, were built between 1954 and 1987. As Cushman & Wakefield’s Andrew Matheny observed: “It’s already starting to tighten to the point that if you’re a tenant looking for 50,000 square feet-plus in Uptown, you don’t really have that many options.” The prediction is that as trophy space fills, tenants will migrate down the quality spectrum—but that trickle-down hasn’t reached the CBD’s 1980s-era commodity product.

C. The Zombie Building Phenomenon

The National’s foreclosure is the marquee example, but it is not unique. A growing number of downtown high-rises are functionally insolvent—their market values have declined below their outstanding debt, and their cash flows cannot fund the tenant improvements needed to compete. In the current rate environment (with the cost of capital far exceeding cap rates on distressed CBD office), these buildings cannot refinance, cannot attract equity, and often cannot sell. They are, in financial terms, zombies—alive on paper, dead in practice.

Texas’ biggest loans headed to foreclosure in February 2026 totaled more than $800 million in troubled commercial property debt, with The National’s approximately $230 million Starwood loan the largest in Dallas.

V. The Conversion Pivot: Hope or Hype?

A. National Rankings and Pipeline

Dallas has emerged as a national leader in adaptive reuse. In 2024, DFW delivered 584 new apartments from office-to-residential conversions—second only to Manhattan (588 units) and fourth overall for conversions of all types (698 units including hotels and schools). Office conversions saw a 34% spike nationally in 2024, and Dallas ranks fifth nationally for the size of its conversion pipeline, with more than 2,720 apartments in various stages of development (79% of upcoming adaptive reuse projects in the metro).

PwC and the Urban Land Institute’s 2026 Emerging Trends report named DFW the #1 commercial real estate market to watch, noting that “office-to-residential and hotel conversions are enhancing Dallas’s standing as a model for other cities to adapt to new styles of working.” RentCafe projects a new national record of 70,700 converted units in 2025—more than triple the 23,100 converted in 2022.

B. Successful Conversion Case Studies

- Santander Tower (1601 Elm St.): Pacific Elm Properties invested $40+ million to convert 14 upper floors of the 50-story Main Street District tower into residential units, with a boutique hotel and refreshed common areas. Completed early 2025. The model for incremental mixed-use repositioning of a functioning office building.

- The Sinclair (I.M. Pei’s former Energy Plaza): Converted by Todd Interests from a 49-story office tower to a 164-unit luxury apartment building with ground-floor retail. One of downtown’s early conversion successes.

- 5550 LBJ Multifamily: Trammell Crow’s High Street Residential is converting LBJ Freeway office buildings into 399 mixed-income apartments (Phase 1: $69 million, construction starting February 2026). Approximately 160 units reserved for residents below 80% AMI. Uses Public Facility Corporation structure for tax exemption.

- Other pipeline: Dallas has 27 buildings that have already been repurposed into 4,797 new apartment units, per RentCafe. Over 90% of downtown residential units under development stem from renovation of existing structures rather than new construction.

C. The Cost Barrier and The National’s Cautionary Tale

The National’s foreclosure is the most important data point in the conversion debate. Todd Interests invested $460 million—backed by $100 million in historic tax credits and $50 million in Dallas TIF dollars—to create 1.5 million square feet of apartments, a Thompson Hotel (219 rooms), restaurants (Monarch, Kessaku, Little Daisy, Catbird, White Rhino Coffee, Chick-fil-A), and offices in the former First National Bank Tower. Despite this massive investment, apartment occupancy had fallen from nearly 95% to as low as 71% (Todd’s estimate in interviews with the Dallas Morning News; elsewhere cited as “below 80%”), driven in part by what Todd attributed to an uptick in violent crime that went largely unchecked until the Safe in the City initiative launched in late 2024. Todd’s blunt assessment in January 2026:

With our debt balance, the interest rate environment and property values downtown, we don’t see a path to recouping our remaining equity. The values aren’t there. The loan is due, and we’re not going to continue to pay.

Todd Interests refinanced with Starwood three years ago. Major investor Moriah Real Estate and Todd recouped roughly 90% of their investment when the loan was refinanced; much of that capital was reinvested in the property in hopes that conditions would change. They didn’t. This marks the first project loss in Todd Interests’ 35-year history. Todd has since exited downtown entirely, selling his stake in the nearby East Quarter development to J.P. Morgan Asset Management.

Strategic Foreclosure, Not Failure of Concept

It is important to distinguish between a project that failed as a concept and a capital structure that became untenable. The National’s mixed-use programming—apartments, hotel, restaurants, office—is fundamentally sound and the property remains operational. Starwood Capital, as the foreclosing lender, will acquire the asset at its outstanding loan balance (~$230 million), which represents roughly 50 cents on the dollar relative to the $460 million total development cost. At that dramatically lower cost basis, Starwood has room to operate with a different economic model: it can afford to lower rents to push apartment occupancy back above 90%, invest in targeted improvements, and wait for the rate environment to normalize—none of which was viable for Todd at the original leverage levels.

Why Starwood Matters Here

Starwood Capital was founded in 1991 specifically to acquire distressed real estate from the Resolution Trust Corporation during the S&L crisis, and has since deployed over $100 billion across every major dislocation cycle. Its playbook is consistent: acquire at deep discounts to replacement cost, stabilize through operational intensity and brand investment, and exit into permanent capital. Key precedents include the $4.5 billion Corus Bank FDIC portfolio (acquired for $554 million in 2009; reworked 40+ non-performing loans and sold 3,100 multifamily units and 6,000+ condos over five years in what Sternlicht called “an extraordinary investment”); the Gansevoort South Beach hotel (acquired through foreclosure in 2012, gut-renovated into the first 1 Hotel, and sold to Host Hotels & Resorts in 2019 for $610 million at rates $700/night higher than the predecessor property); and 17,624 apartment units acquired at 38% below replacement cost in Southeastern U.S. markets including Dallas. Starwood’s SOF XII distressed opportunity fund closed at over $10 billion in 2021. The firm also owns the largest commercial mortgage special servicer in the U.S. (LNR Property), giving it unmatched visibility into distressed real estate workouts. (A note of context: Starwood’s non-traded REIT, SREIT, has faced significant investor pressure since 2022, with NAV down ~40% from peak and ongoing redemption restrictions—a reminder that even sophisticated operators face execution risk in distressed environments.) The National’s next chapter under Starwood will be a bellwether for whether downtown Dallas conversions can work when the capital stack is right-sized.

The lesson: Conversion can work, but the economics are punishing in the current environment. 1980s-era deep-core office buildings require wholesale HVAC and plumbing relocation. Adaptive reuse construction is typically 25–40% lower cost and 25–40% faster than ground-up—but only for the right building type: square or rectangular floorplates, smaller footprints, shallow cores, and (critically) clean ownership structures without ground-lease encumbrances. Texas’s state-level historic and adaptive reuse tax credits remain helpful but are not, as one analyst put it, “a game changer.” New legislation such as SB 840, which allows more apartments and mixed-use residential buildings without separate city approval, may help improve the pipeline’s throughput.

VI. Macro Factors Affecting Dallas CBD

A. Interest Rate Lag and Capital Markets

The elevated cost of borrowing is the single largest impediment to price discovery in downtown Dallas. Assets that might otherwise trade at distressed prices are stuck in limbo: lenders (particularly CMBS special servicers) refuse to sell at levels that crystallize losses, while buyers cannot underwrite acquisitions at cap rates that pencil in a high-rate environment. This is precisely the dynamic behind the Harwood Center’s failed auction and The National’s foreclosure—the gap between what sellers need and what buyers can justify remains too wide.

Dallas’s sales volume bounced back in 2025, with office trades reaching levels not seen since 2022—but the action concentrated in Uptown trophy assets. Cousins Properties’ purchase of The Link at Uptown for $281 million ($747/sf) in July 2025 reflects where institutional capital is comfortable deploying. As JLL wrote in its Q4 2025 report: “Capital is back and ready to be deployed”—but it is highly selective.

B. Public Safety and Perception

Safety—or the perception of it—is a recurring theme in every departure narrative. Governor Abbott publicly blamed crime and homelessness for contributing to corporate exits from downtown. The City’s response has included increasing downtown police presence to a ten-year high of 130 officers, expanding a Dallas Marshal’s Office presence in public spaces like Pegasus Plaza, and partnering with DDI on quality-of-life metrics that have trended positive since late 2024. Downtown’s residential population has grown to roughly 15,000 residents in over 10,000 apartment units.

The company’s announcement does not change our conviction that Downtown Dallas is one of the best places in the country to do business... While this moment is challenging, it also creates space for new opportunities and continued reinvention.

Jennifer Scripps, DDI

C. Property Tax Implications

As downtown tower values decline, the tax burden shifts. The BCG study’s projection of a $2.7 billion property value decline and $62 million annual tax revenue loss from AT&T’s departure alone is a significant fiscal hit. Conversion projects using Public Facility Corporation structures (like 5550 LBJ) are exempt from ad valorem taxes—a tool that supports affordable housing but further erodes the tax base. The estimated total tax revenue forgone on that single project is roughly $170 million over its life. The City will need to reconcile its conversion-friendly posture with the reality of diminishing downtown commercial assessment values.

D. Catalysts and Counterweights

Not all signals are negative. Several major developments provide potential counterweights:

- Goldman Sachs NorthEnd Campus (~$709 million): The 800,000-square-foot all-electric campus adjacent to Victory Park topped out in November 2025 and is expected to house 5,000+ employees when complete in late 2027–2028. It will be the largest hub by square footage in Goldman’s global portfolio. The project anchors the 11-acre NorthEnd mixed-use development by Hunt Realty and Hillwood, with a 1.5-acre urban park. Goldman has had a Dallas presence since 1968 and now employs approximately 4,500 in North Texas. The firm received $18 million in City incentives. JPMorgan provided $513.9 million in construction financing.

- 2026 FIFA World Cup: Dallas will host 9 matches at AT&T Stadium (renamed “Dallas Stadium” for the tournament)—more than any other venue globally. The International Broadcast Center—the nerve center for the world’s media during the tournament—will occupy the Kay Bailey Hutchison Convention Center from January through August 2026, bringing 10,000+ media representatives and a high-security, high-tech, 24-hour support operation to the southern end of downtown. Estimated economic impact: $1.5–$2.1 billion for the DFW region, with 100,000+ visitors per day during match windows. The City approved $15 million in convention center upgrades for FIFA use.

- “Y’all Street” Financial Corridor: For the first time in history, three securities exchanges will be operational in Texas in 2026. The Texas Stock Exchange (TXSE), headquartered in downtown Dallas, received SEC approval in September 2025 and has raised over $250 million from BlackRock, Citadel Securities, Charles Schwab, J.P. Morgan, Goldman Sachs, and Bank of America, with Energy Transfer CEO Kelcy Warren as majority owner. TXSE plans to begin trading in Q1 2026, with corporate listings to follow in H2 2026. NYSE Texas, a reincorporation of NYSE Chicago, launched in August 2025 and is headquartered at Old Parkland in Oak Lawn (28,000 sf). Nasdaq Texas announced in November 2025 with a new regional headquarters in Dallas, pending regulatory approval for 2026 launch. Governor Abbott claims Texas now has the largest financial services workforce in the United States, surpassing New York. The Y’all Street narrative is the strongest counter-narrative to the AT&T exit, but its direct impact on the central business district specifically remains to be demonstrated.

- Convention Center Rebuild: The $3+ billion Kay Bailey Hutchison Convention Center replacement is targeted for 2029 opening, with demolition and construction pausing during 2026 for FIFA use.

- Mavericks / Stars Stadium Discussions: Both franchises have publicly explored new arena possibilities. The Stars have explored relocation to Plano. Any new downtown venue would dramatically reshape land use and foot traffic patterns in the core. The potential demolition of City Hall in favor of a new basketball arena and entertainment district has been discussed as a catalytic project for the core.

E. Political Risk: The Pension Overhang and TIF Sustainability

Investors should not assume that the generous public subsidy environment of 2020–2024 will persist. The City of Dallas faces a $3 billion unfunded pension liability for its Police and Fire Pension System (DPFPS), with the fund currently only 32% funded. In December 2025, the City Council approved a 30-year funding plan that ramps annual contributions from $202 million (2024) to $220 million (2026), with actuarially determined contributions beginning in 2030. The total projected cost to the City over 30 years: approximately $11 billion (some estimates of total pension liabilities, including the Employee Retirement Fund, reach $19 billion over the same period). This pension obligation will consume an increasing share of the City’s general fund, constraining its ability to offer the Tax Increment Financing (TIF) and tax abatement packages that made projects like The National ($50 million in TIF) and Santander Tower viable. The PFC structure used for projects like 5550 LBJ, while effective for affordable housing, further erodes the ad valorem tax base—estimated at $170 million in foregone revenue for that single project. Simultaneously, declining downtown property assessments (the BCG study’s projected $2.7 billion decline from AT&T alone) will compress the very tax increment that funds TIF districts. The result is a potential fiscal squeeze: rising pension obligations, declining commercial assessment values, and political pressure to curtail developer subsidies—all at the moment when conversion projects most need public support to pencil. Investors underwriting conversion plays should stress-test their models against a scenario in which City subsidies are 30–50% lower than recent precedent.

VII. Future Outlook and Strategic Recommendations

A. Short-Term (2026–2027): The Valley

- Expect more foreclosure-by-auction events and buildings reverting to lenders as CMBS loans mature. CoStar forecasts Dallas-area vacancy peaking near 20% metro-wide in 2026–2028—the highest since the S&L crisis of the late 1980s. The CBD will bear a disproportionate share.

- AT&T’s physical presence remains in downtown through at least 2028–2031 (Whitacre Tower lease through December 31, 2031 per AT&T’s own disclosure), but the psychological impact is immediate. Expect secondary and tertiary tenants to re-evaluate downtown commitments. The Comerica-Fifth Third merger adds further uncertainty: while Fifth Third CEO Tim Spence has stated the combined bank will maintain a “very significant presence” in the city, whether that means downtown is “yet to be fully determined,” with the namesake tower lease expiring in 2028.

- The FIFA World Cup (June–July 2026) will provide a temporary economic jolt and global visibility, but its benefits will concentrate in hospitality, entertainment, and retail—not office leasing.

- New construction pipeline is limited: Only 2.0–2.2 million square feet under construction metro-wide, the lowest since 2012 and most of it pre-leased. Supply constraints will eventually benefit even troubled submarkets—but not yet downtown.

B. Mid-Term (2028–2030): The Pivot

- A “Residential First” downtown begins to take shape as conversions add 2,700+ pipeline units to the existing 10,000+ apartments. Downtown’s residential population could approach 20,000, creating the critical mass needed for street-level retail and dining viability.

- Office inventory shrinks further. Downtown has already shed 20% of its office inventory since 1990 (43 million down to 34.3 million square feet). Continued conversions and selective demolition will reduce supply, eventually supporting a vacancy-rate floor.

- The Goldman Sachs NorthEnd campus and new convention center open, providing fresh anchors for the northern and southern edges of the core, respectively.

- Trickle-down from Uptown tightening. As Cushman & Wakefield predicts, once trophy Uptown space fills, tenants will consider “Tier 1” buildings further from the core. Whether that demand reaches true CBD remains to be seen.

C. Investor Strategy Framework

|

Posture

|

Target Profile

|

Rationale

|

|

AVOID

|

Commodity Class B office with high vacancy and no conversion path; assets encumbered by ground leases or structural challenges (e.g., Harwood Center profile)

|

No near-term recovery thesis; TI costs exceed value uplift; financing unavailable in current rate environment

|

|

TARGET

|

Distressed assets with clean fee-simple ownership, conversion-friendly floorplates (pre-1970 or post-2000), and proximity to transit or lifestyle amenities

|

Conversion economics work at distressed pricing; state tax credits available; growing residential demand downtown; 25–40% faster/cheaper than ground-up

|

|

WATCH

|

City of Dallas TIF availability and scale; SB 840 implementation; Mavericks/Stars stadium decisions; FIFA legacy effects; Starwood’s operational strategy for The National post-foreclosure

|

Policy signals will determine which conversions pencil; pension obligations may constrain future TIF commitments; stadium relocation decisions would reshape downtown land use; The National is a bellwether for the de-leveraging thesis

|

VIII. Appendix

A. Key Timeline

|

Date

|

Event

|

|

1914

|

Neiman Marcus opens flagship at Main and Ervay

|

|

1954–1987

|

Downtown Dallas’s 15 tallest towers built

|

|

1990

|

Downtown office inventory peaks at ~43M sf

|

|

2019

|

Pre-COVID downtown vacancy: 21.3%

|

|

2021

|

AT&T opens Discovery District ($100M entertainment campus)

|

|

2021

|

Harwood Center ownership defaults on mortgage

|

|

Feb 2023

|

Todd Interests refinances The National with Starwood

|

|

Feb 2025

|

Saks Global announces Neiman Marcus flagship closure; City intervenes

|

|

Jul 2025

|

Cousins Properties acquires The Link at Uptown ($281M / $747/sf)

|

|

Sep 2025

|

TXSE receives SEC approval

|

|

Oct 2025

|

Harwood Center auction fails; CMBS trust retains asset at 46% occupancy

|

|

Nov 2025

|

Goldman Sachs NorthEnd campus tops out

|

|

Dec 2025

|

City Council approves 30-year, $11B pension funding plan

|

|

Dec 2025

|

K&L Gates vacates Comerica Bank Tower for Harwood District

|

|

Jan 5, 2026

|

AT&T confirms HQ relocation to Plano

|

|

Jan 9, 2026

|

Todd Interests announces The National foreclosure to Starwood

|

|

Jan 14, 2026

|

Saks Global files Chapter 11; van Raemdonck replaces Baker as CEO

|

|

Jan 29, 2026

|

Saks Global closes 57 OFF 5TH stores and all 5 Last Call locations

|

|

Feb 2, 2026

|

Fifth Third / Comerica merger effective ($294B assets); Comerica delists

|

|

Jan–Aug 2026

|

FIFA International Broadcast Center at KBHCC

|

|

Q1 2026

|

TXSE trading launch (expected)

|

|

Jun–Jul 2026

|

2026 FIFA World Cup (9 matches at AT&T Stadium)

|

|

Late 2027–2028

|

Goldman Sachs NorthEnd opening; AT&T Plano campus partial occupancy

|

|

2029

|

New Kay Bailey Hutchison Convention Center targeted opening

|

B. Glossary of Key Terms

CMBS (Commercial Mortgage-Backed Securities): Pools of commercial real estate loans packaged into securities and sold to investors. When the underlying loan defaults, a “special servicer” takes over management of the distressed asset.

Special Servicer: A firm (e.g., CWCapital) appointed to manage troubled loans within a CMBS trust, with authority to modify, foreclose, or sell the underlying property.

Ground Lease: A long-term lease of land on which the tenant constructs improvements. The tenant owns the building but not the land, which reverts to the landowner at lease expiration. Complicates financing and resale because lenders have subordinate claims.

Ransom Parcel: A small, separately owned parcel of land within or beneath a larger development that gives its owner effective veto power over whole-asset transactions or redevelopment. The owner of the ransom parcel can demand disproportionate consideration for cooperation, “holding hostage” the larger project.

Shadow Vacancy: The gap between contractually leased office space and physically occupied space. A building may show 70% leased occupancy but have only 30–40% of desks in use on a given day due to remote and hybrid work patterns. Shadow vacancy represents deferred negative absorption—a pipeline of future contractual vacancy that will materialize as leases expire and tenants right-size.

TIF (Tax Increment Financing): A public financing method where future tax revenue increases from a defined district are used to subsidize current development. Dallas has used TIF extensively for downtown conversion projects.

Net Absorption: The net change in occupied space over a given period. Positive absorption means more space was leased than vacated.

Adaptive Reuse: Converting an existing building from one use (e.g., office) to another (e.g., residential, hotel). Typically 25–40% faster and cheaper than ground-up construction for suitable building types.

SB 840: Texas legislation allowing more apartments and mixed-use residential buildings without requiring separate city approval, potentially streamlining the conversion pipeline.

Public Facility Corporation (PFC): A Texas legal structure that allows municipalities to partner with developers on affordable housing projects, providing ad valorem tax exemption in exchange for income-restricted units.

DPFP (Dallas Police and Fire Pension System): The pension fund for Dallas first responders, carrying an approximately $3 billion unfunded liability as of 2025 (32% funded). A 30-year funding plan was adopted in December 2025, requiring escalating City contributions that constrain discretionary spending, including economic development subsidies.

C. Key Sources

Note: Sources dated Q3 2025 or earlier predate the January 5, 2026 AT&T headquarters announcement and the January 2026 distress events (The National foreclosure, Saks Global bankruptcy). Vacancy and absorption figures in those reports reflect a materially different market baseline.

- CoStar Group market data (Q4 2025)

- JLL Fourth Quarter 2025 Dallas Office Report

- Cushman & Wakefield Q1/Q3 2025 Dallas Office Reports (pre-AT&T announcement)

- Partners Real Estate DFW Market Insights (Q2/Q3 2025) (pre-AT&T announcement)

- Avison Young Dallas Office Market Report (Q3 2025) (pre-AT&T announcement)

- Bradford Companies DFW Office Market Insights

- Dallas Morning News reporting (Harwood Center, AT&T, The National, Neiman Marcus, Pension)

- D CEO Magazine / D Magazine commercial real estate coverage

- The Real Deal Texas

- Bisnow Dallas-Fort Worth

- RentCafe 2024/2025 Adaptive Reuse Reports

- PwC / Urban Land Institute Emerging Trends in Real Estate 2026

- SEC filings (COMM 2014-UBS5)

- North Texas FIFA World Cup Organizing Committee / Dallas Sports Commission

- Colliers “From Stadiums to Skylines” DFW Report (August 2025)

- Texas Tribune (“Despite strong economy, Texas cities grapple with excess office space”)

- Bloomberg / CRE Daily (Dallas pension coverage)

- TXSE Group Inc. / SEC Form 1 filings

- NBC DFW / WFAA (pension settlement coverage)

DISCLAIMER

This briefing is provided for informational and discussion purposes only and should not be relied upon for investment decisions. It does not constitute investment advice, a recommendation, or a solicitation to buy or sell any security or real property interest. The author and Elm Tree Partners may hold positions in securities or assets mentioned. All data is sourced from publicly available information including broker reports, SEC filings, municipal records, and press coverage as of February 2026. Market conditions are subject to rapid change. Past performance is not indicative of future results. Commercial real estate investments involve substantial risk of loss.